Breakout trading is a popular strategy used by intraday traders to capitalize on significant price movements that occur when a stock or security breaks out of a defined range or pattern. Here's an outline of a basic breakout trading strategy:

Entry Criteria:

- Identify a stock or security that has shown a period of consolidation or a tight trading range for at least the past few hours.

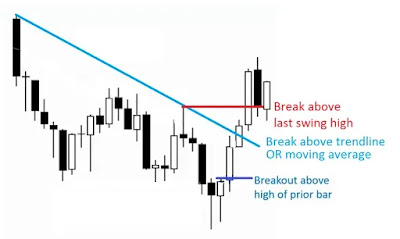

- Set an entry trigger price slightly above the upper boundary of the trading range (resistance level). This trigger price should be the point at which the price breaks out of the consolidation phase, indicating a potential upward trend.

- Confirm the breakout with an increase in trading volume. Higher volume during the breakout indicates stronger momentum and higher chances of a successful trade.

- Place a buy order above the trigger price to enter the trade.

Exit Criteria:

- Set a target price to take profits. This target price should be based on technical analysis, such as the next resistance level or a predetermined profit target.

- Place a limit sell order at the target price to automatically exit the trade and secure profits if the price reaches the desired level.

- Implement a stop-loss order to protect against potential losses. Set a stop-loss price slightly below the trigger price or a support level. If the price falls to this level, the trade will be automatically exited to limit losses.

Risk Management:

- Determine a maximum risk per trade as a percentage of your trading capital (e.g., 1-2%).

- Calculate the difference between the entry price and the stop-loss price. Based on the maximum risk percentage, determine the appropriate position size (number of shares or contracts) to maintain the risk within the desired range.

- Adjust the position size according to the actual trade setup and risk parameters.

Additional Considerations:

- Monitor the trade closely and be prepared to manually exit if there are significant changes in market conditions or unexpected news that could affect the trade.

- Avoid trading during volatile market periods, such as major economic announcements or earnings releases, as they can lead to unpredictable price movements.

Remember, it's crucial to thoroughly back test and validate any trading strategy before applying it with real money. Additionally, consider consulting with a financial advisor or professional trader to ensure the strategy aligns with your individual goals and risk tolerance.

Comments

Post a Comment