Options trading can be a complex but rewarding investment strategy that allows you to speculate on price movements, generate income, or manage risk. Here's a beginner's guide to help you get started with options trading:

1. Understand the Basics:

What are Options? Options are financial derivatives that give you the right (but not the obligation) to buy or sell an underlying asset (such as stocks, ETFs, or indices) at a predetermined price (strike price) within a specified time period (expiration date).

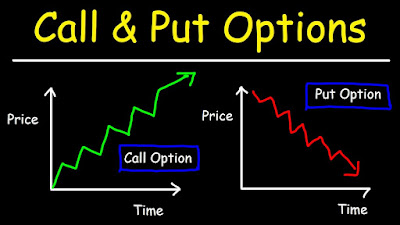

Call Options: These give you the right to buy the underlying asset at the strike price before the expiration date.

Put Options: These give you the right to sell the underlying asset at the strike price before the expiration date.

2. Learn Key Terminology:

Strike Price: The price at which the underlying asset can be bought or sold.

Premium: The price you pay to buy an option.

Expiration Date: The date when the option contract expires.

In-the-Money (ITM), At-the-Money (ATM), Out-of-the-Money (OTM): Describes the relationship between the option's strike price and the current market price of the underlying asset.

3. Choose a Trading Platform:

Select a reputable online brokerage that offers options trading. Look for user-friendly platforms with educational resources and tools for analyzing options strategies.

4. Educate Yourself:

Study options trading guides, books, and online tutorials to build a solid foundation. Understand concepts like option pricing, volatility, and the Greeks (Delta, Gamma, Theta, Vega).

5. Start with Basic Strategies:

Buying Calls/Puts: A straightforward strategy where you purchase call options if you expect the price to rise or put options if you expect the price to fall.

Covered Calls: Sell call options against shares of stock you already own to generate income.

6. Practice with Virtual Trading:

Many platforms offer virtual trading accounts where you can practice options trading without risking real money.

7. Understand Risk Management:

Options trading involves risks, including the potential loss of the entire premium paid. Only trade with capital you can afford to lose.

8. Gradually Expand to Advanced Strategies:

As you gain confidence, explore more advanced strategies like spreads (e.g., vertical, horizontal, diagonal), straddles, strangles, and iron condors.

9. Keep Learning and Adapting:

Markets and strategies evolve. Stay up-to-date with news, trends, and trading techniques.

10. Be Patient and Disciplined:

Options trading requires patience and discipline. Avoid making impulsive decisions and stick to your trading plan.

11. Seek Professional Guidance:

Consider consulting a financial advisor or trading professional, especially if you're new to options trading. They can provide personalized guidance based on your financial goals and risk tolerance.

12. Start Small:

Begin with small positions and gradually increase your exposure as you gain experience and confidence.

Remember that options trading carries significant risks and is not suitable for all investors. It's important to thoroughly educate yourself, practice with virtual trading accounts, and start with caution. Options trading involves a learning curve, so take your time to understand the nuances and complexities of this investment strategy.

Comments

Post a Comment